this is not "investment analysis" in the traditional sense. No DCF projections. No big narratives about the how and the when things will happen in the future. No spreadsheets. None of the stuff the MBA nerd finds comforting.

This is based on simply looking at the present. Observing what is, for what it is.

my grandma

I know that my grandma is more fragile than my son.

I know this with certainty. I don't need to predict their behavior. I don't need to model their future health trajectories. I don't need to consult an actuary. I just need to look at them. Right now. In the present. The information is there.

Fragile entities don't do well under stress. This is not a prediction. It's a property. You can see it right there in front of you, like a cracked foundation. You don't need a forecast to know that it will fare worse in an earthquake. You just need eyes.

balance sheet and leverage

Now... a balance sheet.

A company that is overleveraged is more fragile than a company with no debt. Full stop. No need to open Excel. No need to project cash flows ten years out. No need to build sensitivity tables or argue about terminal values. Just look at a snapshot, a single photograph of the balance sheet, and the fragility is visible.

Oracle's debt balance is massive. Its debt-to-EBITDA ratio should place it deep in junk territory. And yet, they keep raising debt, and then some more. As if the fragility were a feature, not a bug.

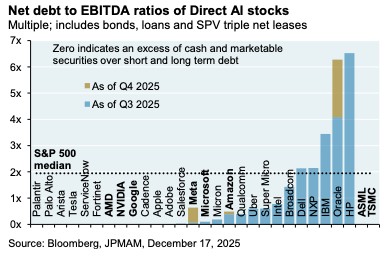

Now compare Oracle's leverage with that of the other hyperscalers. Michael Cembalest at J.P. Morgan published the chart below in his 2026 Eye on the Market outlook, "Smothering Heights". It shows net debt-to-EBITDA ratios for the major AI-linked companies. Most hyperscalers have negative ratios — meaning they have more cash than debt. Then there's Oracle.

Oracle is like my grandma. What could go wrong?

Leverage collapses the distance from master of the universe to bankrupt. It compresses an entire lifetime of outcomes into a very short window. This is not a metaphor. It's arithmetic.

Oracle and my grandma don't like stressors.

And time is the ultimate stressor. It just needs to pass. That's all: enough time for the thing that was always going to happen to happen.

buying puts (not on grandma)

Therefore and in sum: I'm buying out-of-the-money, high-convexity, long-dated put options on Oracle.

I'll let time do its thing (with Oracle... for grandma, I'll do everything I can to keep her happy and healthy.)

The position is not sufficiently large to make F-you money. But it's placed out of principle. Not because the expected value demands it, but because the logic is clean. The fragility is visible and the cost of being wrong is small relative to the asymmetry of being right.

I'm not predicting anything. I'm just watching the present.